Pace Risk Consulting specializes in developing policy structures that cover property damage, business interruption, third-party liability, environmental liability, and cyber risks for energy generation and distribution assets.

We design project-specific insurance programs and provide consulting services to secure the most favorable coverage terms from global and local markets. Our goal is to mitigate revenue fluctuations, maintain operational continuity, and ensure manageable risks.

Biomass power plants contribute to sustainability and low-carbon goals by converting energy generated from organic waste and biomass sources into electricity. However, disruptions in the raw material supply chain, fuel quality fluctuations, supply system failures, emissions control issues, and regulatory changes pose significant risks.

At Pace Risk Consulting, we develop customized policy plans, including All Risks Insurance, and source the most suitable offers from global and local insurance markets. We support operational safety, environmental compliance, and investment return through engineering-backed risk analyses, periodic audits, and accurate claim management.

Natural gas power plants offer the advantages of rapid startup and low emissions; however, equipment failures and maintenance interruptions, such as combustion systems, combined cycle units, gas turbines, and boilers, can pose serious operational risks. Pipeline leaks, explosion risks, and environmental liabilities also impose additional financial and legal burdens.

Pace Risk Consulting determines policy terms based on the facility's technical and operational structure and explores the most suitable coverage options from local and international markets. Risk assessments, periodic inspections and loss assesment support facility reliability and return on investment.

Electricity and natural gas distribution infrastructures contain critical equipment, from high-voltage power lines to transformer substations, from stations to the end user. These assets are vulnerable to equipment failures, natural disasters, supply chain interruptions, and cyber threats.

Pace Risk Consulting creates tailored coverage structures for licensed distribution companies based on All Risks Insurance, coordinating the provision of the most favorable conditions in the market. It contributes to maintaining operational security and investment return through engineering-backed risk assessments.

Solar power plants play a critical role in sustainable energy production; however, panel failures due to high temperatures, installation errors, severe weather conditions, fire, and cyber threats can lead to production losses.

As Pace Risk Consulting, we determine appropriate policy structures, including All Risks Insurance, and optimize coverage terms with insurance companies. We support investment return and operational continuity through engineering-based preventative recommendations, periodic inspections and loss monitoring.

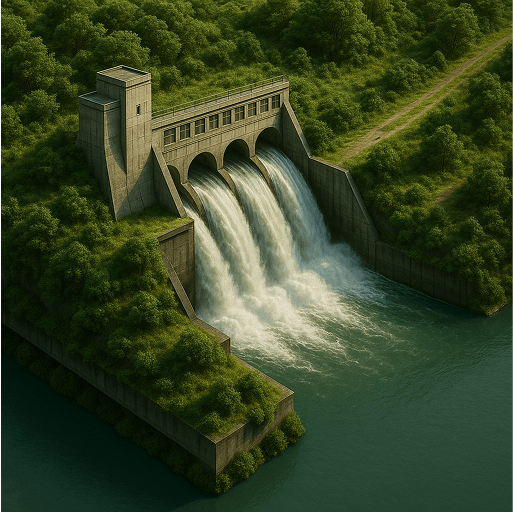

Hydroelectric power plants, which convert water's kinetic energy into electricity, face risks such as flow fluctuations, structural stresses, flood risks, climate impacts, and cyber threats.

Pace Risk Consulting structures insurance programs covering the construction and operation periods, coordinates the provision of appropriate coverage and ensures favorable market conditions. We support long-term safety and efficiency goals with periodic inspections, early warning systems and risk mitigation strategies.

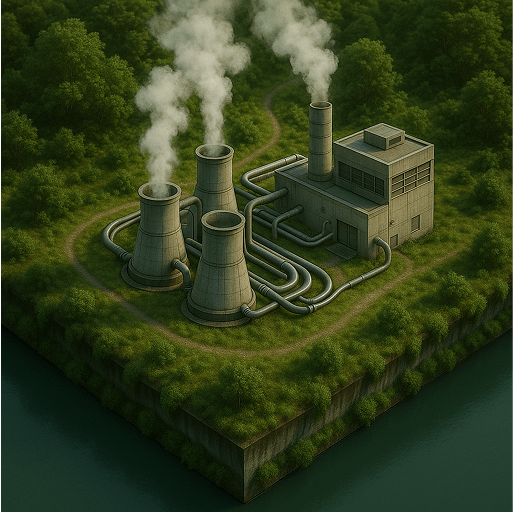

Geothermal facilities are vulnerable to equipment wear due to high temperatures and corrosion, drilling and pressure control risks and environmental impacts.

Pace Risk Consulting determines policy terms throughout the entire process, from the drilling phase to the operational phase, and secures the most suitable options from the insurance market. It supports facility safety and return on investment through engineering-backed preliminary analyses, early warning applications and loss assesment activities.

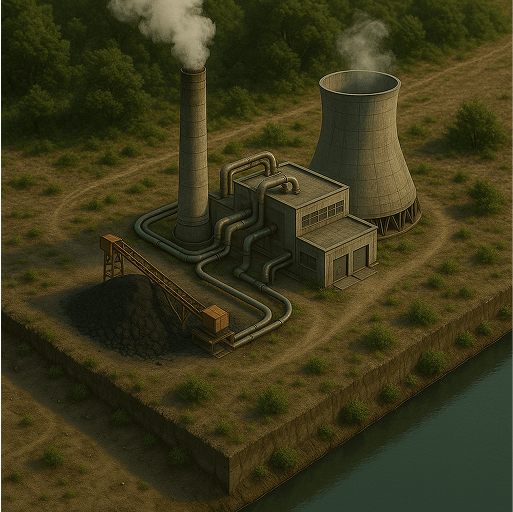

Despite their high capacity advantage, coal-fired power plants carry complex risks due to high temperatures in boilers and chimney systems, emissions regulations and climate policy changes.

Pace Risk Consulting designs the appropriate insurance structure for the project, including All Risks Insurance, environmental liability, business interruption, and regulatory compliance coverage. It contributes to performance and compliance targets through market research, periodic checks, emissions measurements and loss assesment activities.

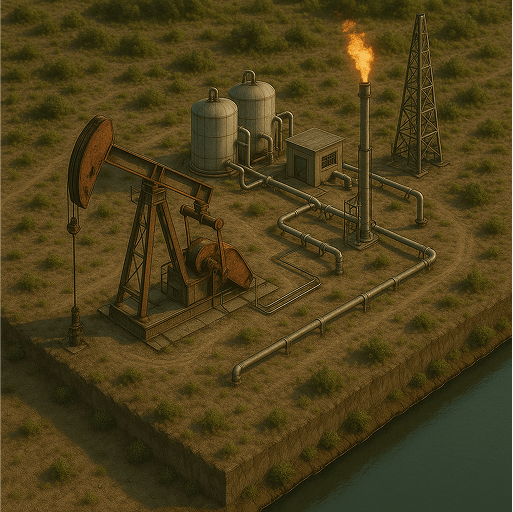

In the oil and gas industry, the upstream (drilling, extraction, production), midstream (pipelines, storage, transportation), and downstream (refinery, petrochemical production, distribution) stages present risks such as high pressure, fire, corrosion, leaks, logistics security and environmental risks.

Pace Risk Consulting accurately determines policy coverage for each of these stages and coordinates the provision of the most favorable coverage terms from domestic and international insurance companies. It conducts technical, environmental, and cyber risk analyses and contributes to the preservation of financial security and operational continuity through engineering-supported assessments, periodic checks and loss assesment activities.

From turbine installation to operation, wind farms face risks such as high-rise structures, harsh weather conditions, mechanical failures, and cyber threats.

Pace Risk Consulting determines policy structures specific to the construction, installation, and operation periods, and provides consulting services to manage the most favorable conditions in global and local markets. With turbine model-specific risk analyses, engineering-supported maintenance recommendations and loss assesment activities. It reduces uncertainties during the facility's financing phase and supports sustainable performance goals throughout its lifespan.

Receivable/credit risk, supply and revenue disruptions, contract defaults, cyberattacks, and reputational risks can have serious operational and financial impacts on organizations.

Pace Risk Consulting designs customized coverage structures for these risks and provides consulting services in negotiations with insurance companies. This protects cash flow and makes uncertainties manageable.

Banks and financial institutions can experience financial and reputational losses due to incidents such as employee misconduct, theft, robbery, and fraud.

Pace Risk Consulting determines policy terms for these risks and secures the most favorable quotes from domestic and international insurance companies. It also monitors the claims process in the event of a claim, contributing to the accurate and swift settlement of claims.

Professional service providers may harm third parties due to errors, negligence, or incomplete performance while performing their duties.

Pace Risk Consulting determines the scope of professional liability coverage and coordinates the provision of optimal market conditions. It helps effectively manage risk by structuring coverage such as litigation expenses, compensation payments, and defense costs.

Artworks carry the risk of physical damage or loss during transportation, display, and storage.

Pace Risk Consulting determines policy coverage for collectors and secures the most favorable coverage terms from insurance companies. It offers preventative recommendations for packaging, transportation, and storage to minimize risk.

Cyberattacks can have serious consequences, including data breaches, operational disruptions, legal claims, and reputational damage.

Pace Risk Consulting determines the scope of cyber risk coverage and provides the most suitable offers from global and local markets. It also provides support in pre-cyber incident risk mitigation and post-incident process management.

Product defects can lead to bodily injury, property damage and legal claims.

Pace Risk Consulting determines the right coverage for product liability insurance, conducts market research, and coordinates the provision of the most favorable terms. It also manages communication between the manufacturer or seller and the insurer during the claims process.

Board members and senior executives bear personal liability risks due to their decisions and actions.

Pace Risk Consulting structures executive liability coverage and secures the most suitable coverage.. This helps minimize individual executive liability and strengthen the company's corporate security.

Fire, explosion, natural disaster, equipment failure, and production interruption pose serious risks to industrial facilities.

Pace Risk Consulting provides support in structuring All-Risk fire insurance and supplemental coverage solutions. We provide consulting services to ensure the most favorable terms and conditions are secured from insurance companies and assist in determining the correct coverage through risk analyses.

Construction and assembly projects pose significant risks for the employer, contractor, third parties, and financing providers.

Pace Risk Consulting designs insurance programs for each critical stage of the project process and provides consulting services to secure the most favorable coverage terms available in the market. Investment continuity and financial security are supported through engineering-backed risk analyses, process checks and loss assesment.

Contact us to get in touch with an expert in a specific industry or risk topic, learn more about a particular solution, or send a sales/quote request.